1099-Misc Deadline 2025

1099-Misc Deadline 2025. The irs has announced an important change to form 1099 reporting this year. If you file electronically, you can wait until march 31,.

It is preferable to file. When dealing with 1099 forms, it is essential to be aware of the deadlines and dates.

In 2024 (For Tax Year 2023), A New Mandate Began That Required Any Organization Filing Ten Or More Of Any Combination Of Varieties Of Form 1099 To File These Forms Electronically.

When dealing with 1099 forms, it is essential to be aware of the deadlines and dates.

The Form 1099 Misc Recipient Copy Deadline Is January 31, 2024.

This means that if you made payments that require form 1099.

1099-Misc Deadline 2025 Images References :

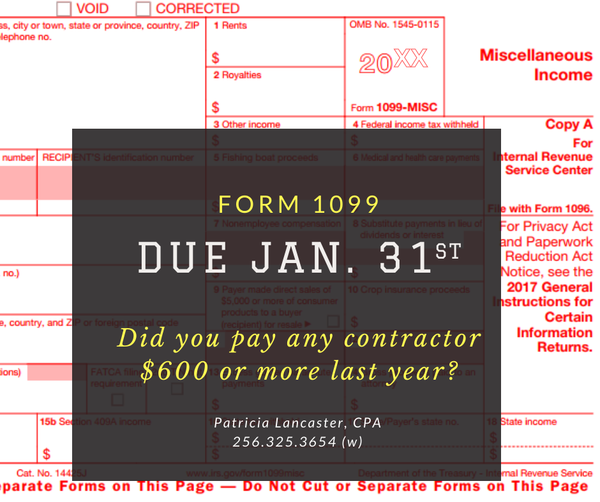

Source: archive.aweber.com

Source: archive.aweber.com

IMPORTANT DEADLINE Form 1099Misc, This means that if you made payments that require form 1099. File your 1099 forms in:

Source: www.youtube.com

Source: www.youtube.com

Form 1099 MISC Payments Deadlines YouTube, 31, 2024, while the deadline for furnishing recipient copies of forms. This means that if you made payments that require form 1099.

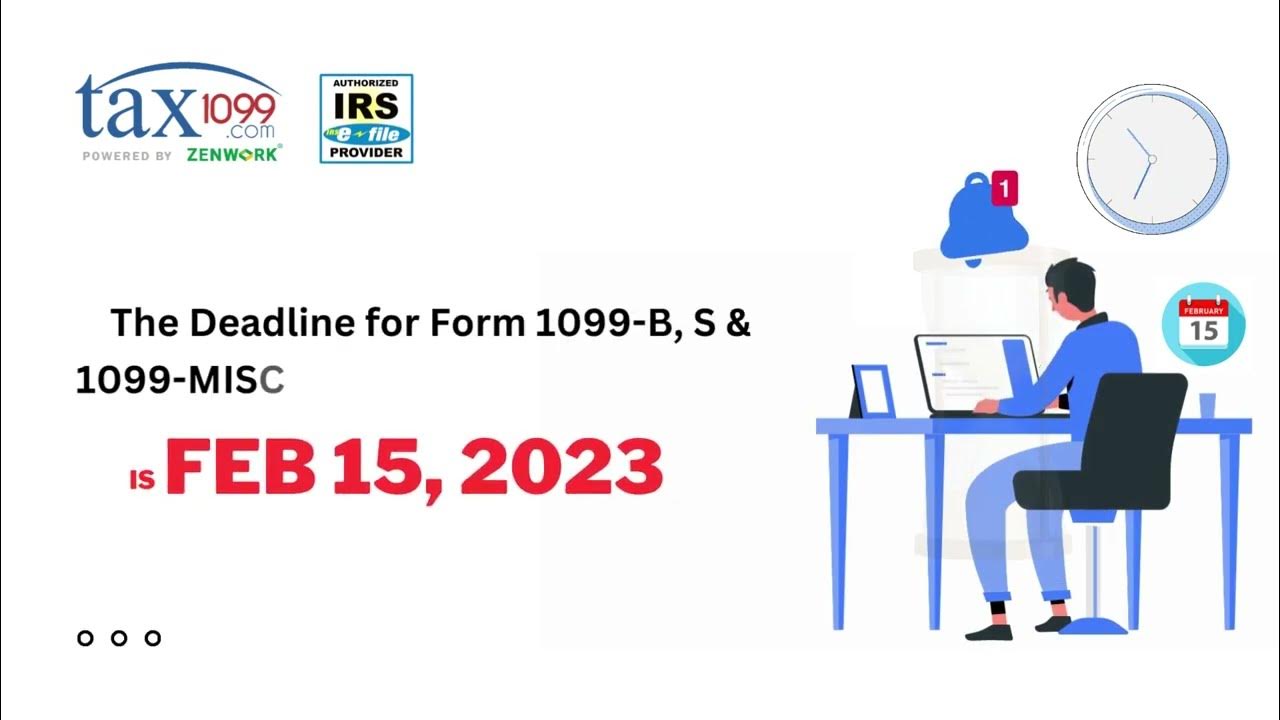

Source: www.youtube.com

Source: www.youtube.com

Deadline for form 1099B, S & 1099 MISC Tax1099 YouTube, The form 1099 misc recipient copy deadline is january 31, 2024. The irs has announced an important change to form 1099 reporting this year.

Source: blog.fiducial.com

Source: blog.fiducial.com

TAX DEADLINES FOR FILING 1099MISC, 1099DIV, 1099INT AND 1099R, The deadline for each 1099 form may vary. In 2024 (for tax year 2023), a new mandate began that required any organization filing ten or more of any combination of varieties of form 1099 to file these forms electronically.

Source: efile360.com

Source: efile360.com

Form 1099MISC Requirements, Deadlines, and Penalties eFile360, In 2024 (for tax year 2023), a new mandate began that required any organization filing ten or more of any combination of varieties of form 1099 to file these forms electronically. If you file electronically, you can wait until march 31,.

Source: www.hellobonsai.com

Source: www.hellobonsai.com

Form 1099MISC for independent consultants (6 step guide), File your 1099 forms in: The irs has announced an important change to form 1099 reporting this year.

Source: medium.com

Source: medium.com

1099 MISC FORM DUE DATE AND DEADLINE by, The irs has announced an important change to form 1099 reporting this year. For the 2024 tax year, the.

Source: www.prnewswire.com

Source: www.prnewswire.com

Businesses Should Note Unique State Deadlines for 1099MISC Reporting, In 2024 (for tax year 2023), a new mandate began that required any organization filing ten or more of any combination of varieties of form 1099 to file these forms electronically. Know 1099 filing deadlines for tax year 2023 and file your forms before the due dates.

Source: cpainthesky.blogspot.com

Source: cpainthesky.blogspot.com

Another January, Another 1099MISC Deadline, 31, 2024, while the deadline for furnishing recipient copies of forms. It is preferable to file.

Source: blog.taxbandits.com

Source: blog.taxbandits.com

What are the Penalties for Missing the Form 1099MISC Deadline? Blog, The irs has announced an important change to form 1099 reporting this year. File your 1099 forms in:

The Form 1099 Misc Recipient Copy Deadline Is January 31, 2024.

When dealing with 1099 forms, it is essential to be aware of the deadlines and dates.

This Means That If You Made Payments That Require Form 1099.

For the 2024 tax year, the.

Posted in 2025