2025 Tax Calculator Married Filing Jointly

2025 Tax Calculator Married Filing Jointly. See current federal tax brackets and rates based on your income and filing status. Your tax filing status, along with your assigned tax.

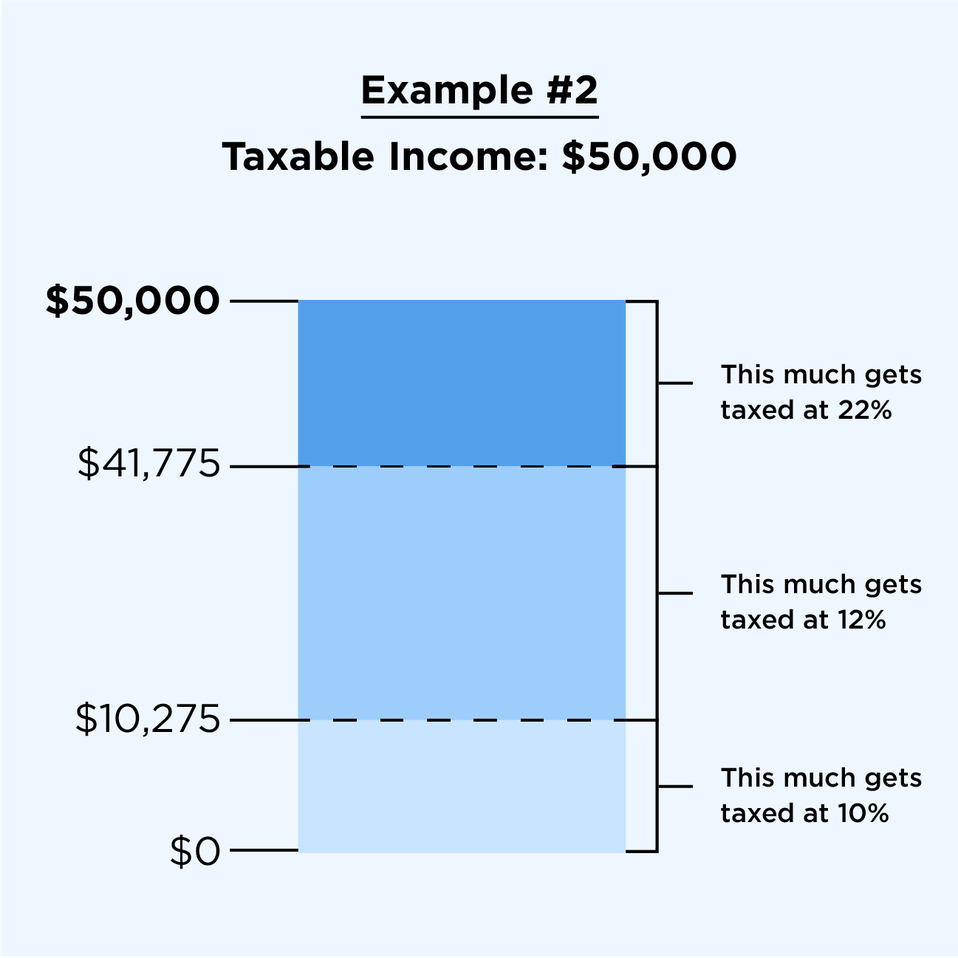

2024 tax brackets calculator married jointly for example, just because a married couple files a joint return with $100,000 of taxable income in 2024 and their total taxable income. As soon as new 2025 relevant tax year data has been.

Based On Your Annual Taxable Income And Filing Status, Your Tax.

2024 tax brackets calculator married jointly for example, just because a married couple files a joint return with $100,000 of taxable income in 2024 and their total taxable income.

Your Tax Filing Status, Along With Your Assigned Tax.

Plan your next tax return due in 2025.

2025 Tax Calculator Married Filing Jointly Images References :

Source: childfreewealth.com

Source: childfreewealth.com

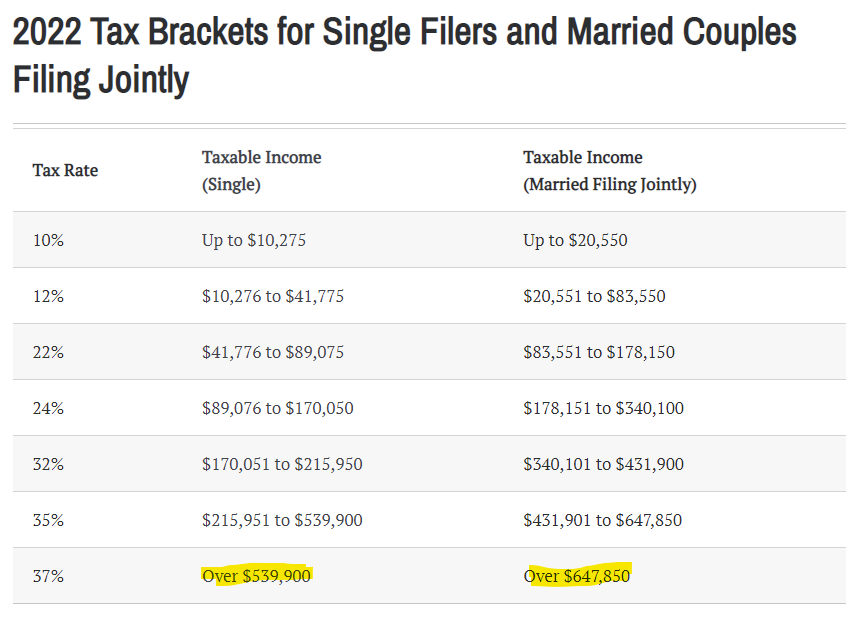

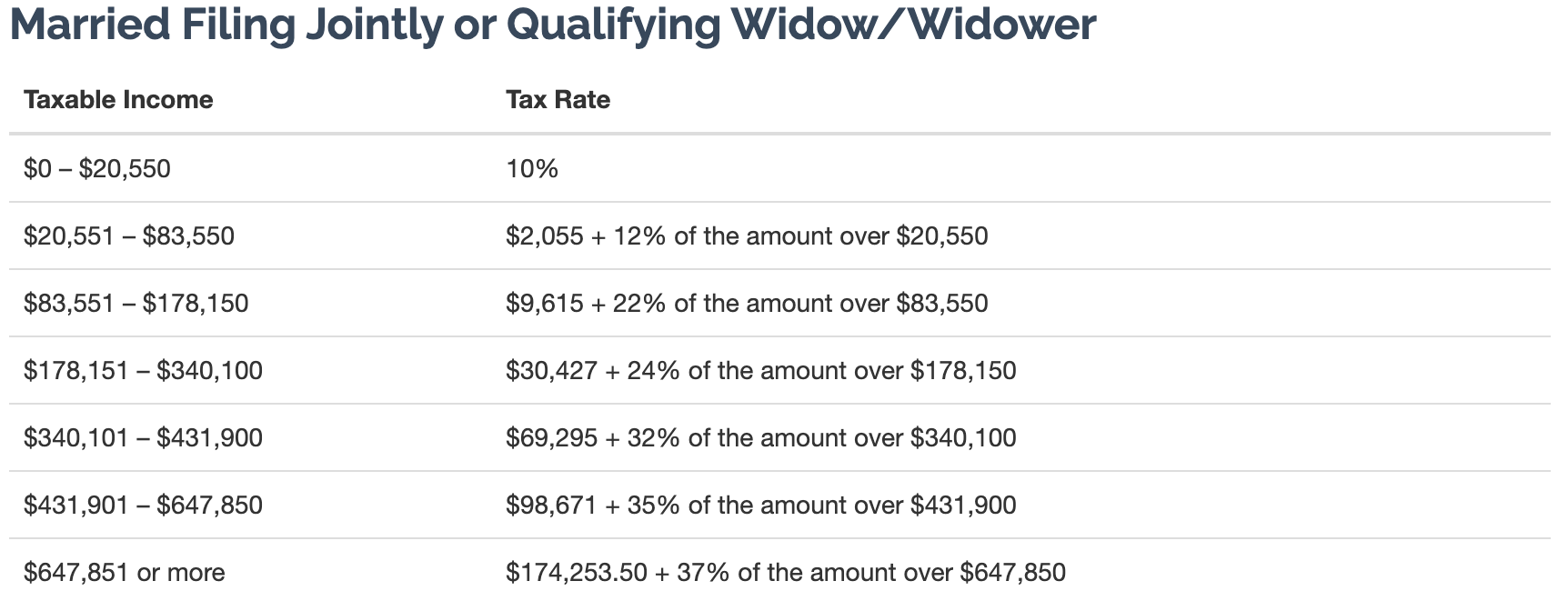

If I'm Married, Should I Always File Taxes Jointly?, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Simply enter your taxable income and filing status to find your top tax rate.

Source: www.aceableagent.com

Source: www.aceableagent.com

The Definitive Guide to Paying Taxes as a Real Estate Agent, In 2026, the deduction would be reduced. Tax brackets 2024 usa married filing jointly jessi lucille, the 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once.

Source: www.youtube.com

Source: www.youtube.com

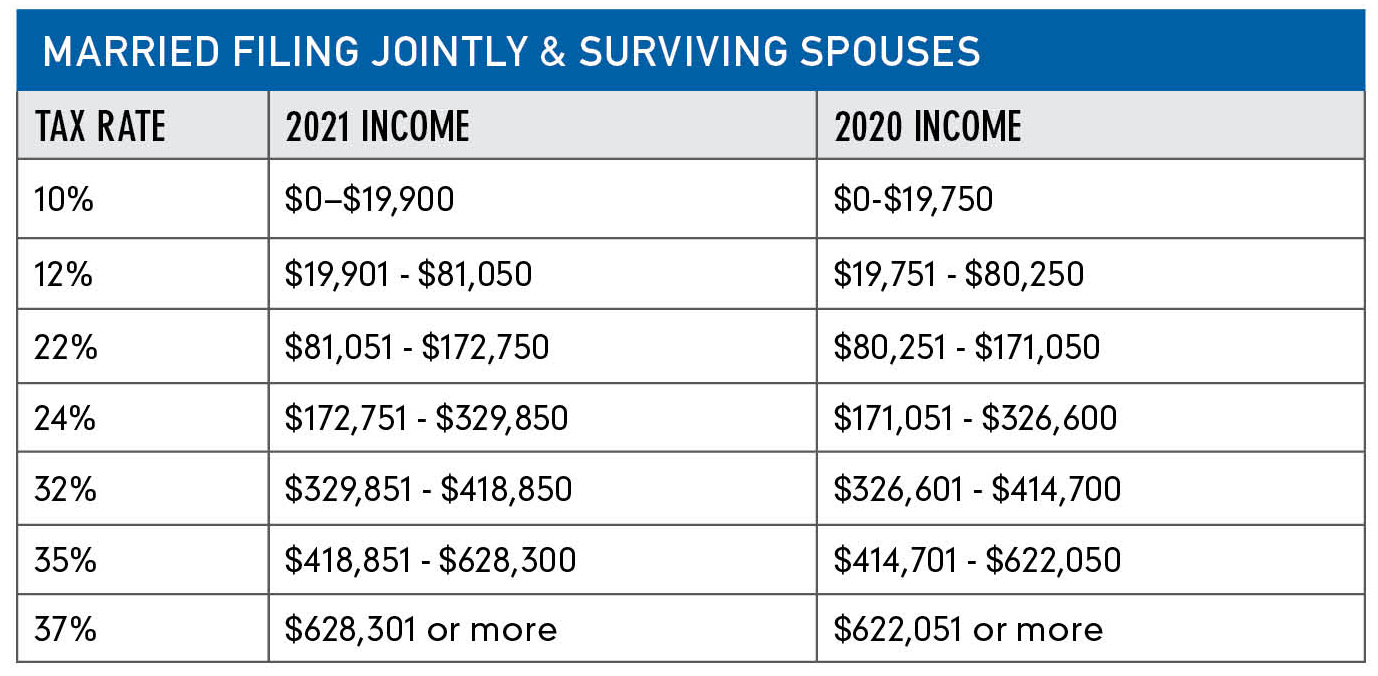

Married Couples File Taxes Jointly or Separately YouTube, For tax year 2024, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%. You can either be single, married filing separately, married filing jointly, the head of a household, or a qualified widow(er).

Source: dollarkeg.com

Source: dollarkeg.com

How much taxes for married filing jointly Dollar Keg, 2025 federal tax rate, bracket calculator. You pay tax as a percentage of your income in layers called tax brackets.

Source: wpdev.abercpa.com

Source: wpdev.abercpa.com

marriedfilingjointlytaxbrackets, Your tax filing status, along with your assigned tax. Tax year 2025 currently is using 2023 data as 2024 data have not be released.

Source: crossborderplanner.com

Source: crossborderplanner.com

The Ultimate Tax Guide How the USA taxes married couples, 2022 tax brackets irs married filing jointly dfackldu, single, married filing jointly, married filing separately, or head of household. Your tax filing status, along with your assigned tax.

Source: emmelinewcamile.pages.dev

Source: emmelinewcamile.pages.dev

2024 Tax Brackets Married Filing Separately Synonym Wylma Rachael, Choose from one of the four tax filing statuses available (single, head of household, married filing separately, or married filing jointly). Married filing jointly or married filing separately.

Source: amaletawbobbye.pages.dev

Source: amaletawbobbye.pages.dev

2024 Irs Tax Brackets Married Filing Jointly Celine Lavinie, The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: e.tpg-web.com

Source: e.tpg-web.com

Stern Kory Sreden & Tax Planning Guide 2021 Tax Planning, See current federal tax brackets and rates based on your income and filing status. Estimate your tax refund or how much you may owe the irs with taxcaster tax calculator.

Source: www.youtube.com

Source: www.youtube.com

How to fill out IRS Form W4 Married Filing Jointly 2022 YouTube, Plan your tax withholding, tax refund, or taxes due. When deciding how to file your federal income tax return as a married couple, you have two filing status options:

You Pay Tax As A Percentage Of Your Income In Layers Called Tax Brackets.

Tax year 2025 currently is using 2023 data as 2024 data have not be released.

See Current Federal Tax Brackets And Rates Based On Your Income And Filing Status.

Tax brackets 2024 usa married filing jointly jessi lucille, the 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once.

Category: 2025