Form 990 Deadline 2025

Form 990 Deadline 2025. It's important to note that an organization can request. Nonprofits with a 990 deadline today can file 8868 and extend their deadline to november 15, 2024.

The deadline for filing form 990 is the 15th day of the 5th month after your organization’s accounting period ends. It’s important to note that an organization can request.

If The Due Date Falls On A Saturday, Sunday, Or A Legal Holiday, You Can.

The irs filing deadline for organizations with a fiscal year end date of 2/29/2024 is midnight eastern time on monday, july 15, 2024.

To Use The Tables, You Must Know.

If your organization’s accounting tax period starts on march 01, 2023, and ends on february 29, 2024, your form 990 is due by.

Form 990 Deadline 2025 Images References :

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png) Source: www.investopedia.com

Source: www.investopedia.com

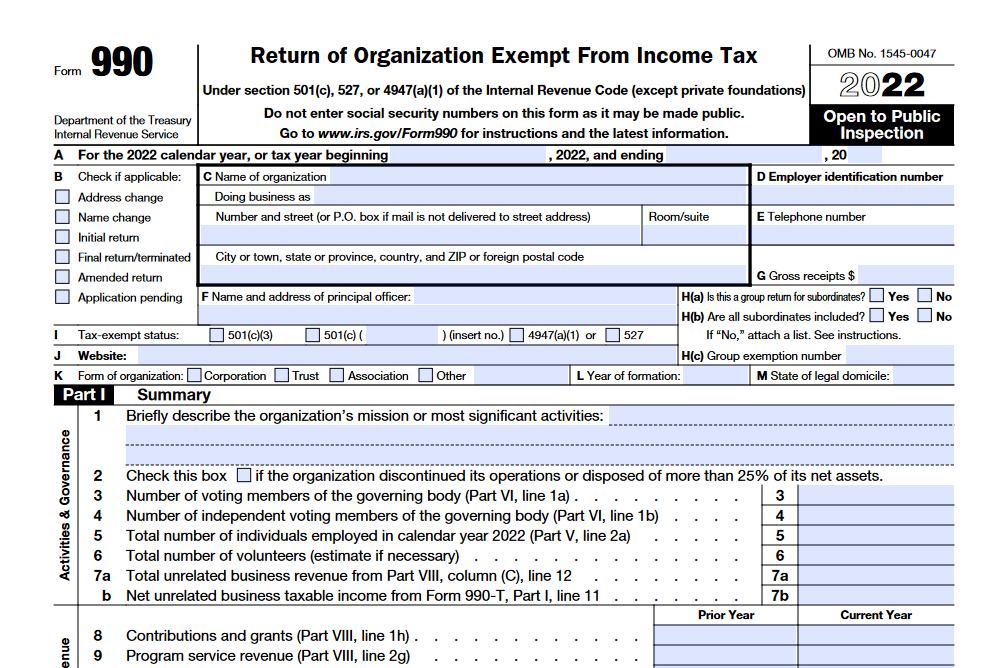

Form 990 Return of Organization Exempt from Tax Overview, Nonprofits with a 990 deadline today can file 8868 and extend their deadline to november 15, 2024. Ending date of tax year.

Source: irs-990-form.com

Source: irs-990-form.com

Form 990 Online Fillable & Printable, Download Blank Sample in PDF, Ending date of tax year. With the deadline quickly approaching, organizations need to know what to expect when they file and also be.

Source: hayes.cpa

Source: hayes.cpa

The Form 990 Deadline is Approaching Hayes CPA, For organizations with an accounting tax period starting on march 01, 2023, and ending on february 29, 2024, form 990 is due by july 15, 2024. File form 990 online to the irs.

Source: www.aplos.com

Source: www.aplos.com

Nonprofit Form 990 Deadline Do I Need To File? Aplos Academy, The standard deadline for calendar tax year. Form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either.

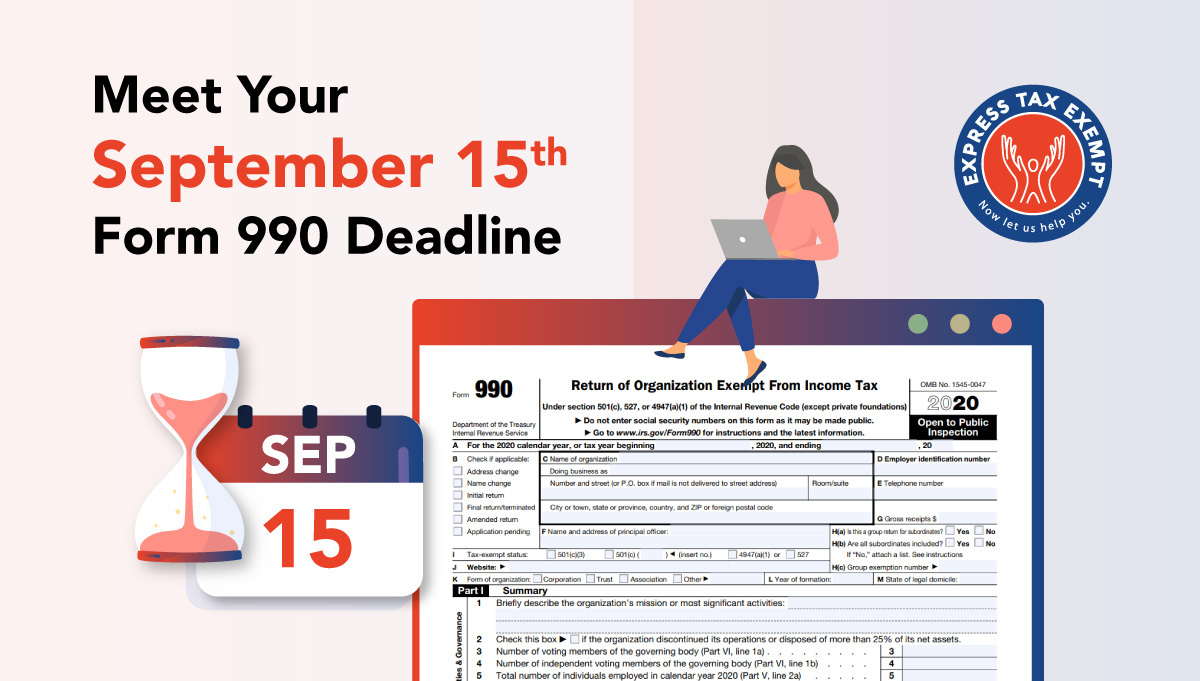

Source: blog.expresstaxexempt.com

Source: blog.expresstaxexempt.com

Meet Your September 15th Form 990 Deadline With ExpressTaxExempt, The download files are organized by month. The irs filing deadline for organizations with a fiscal year end date of 2/29/2024 is midnight eastern time on monday, july 15, 2024.

Source: issuu.com

Source: issuu.com

Quick Guide to file form 990N by Tax990 Issuu, With the deadline quickly approaching, organizations need to know what to expect when they file and also be. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

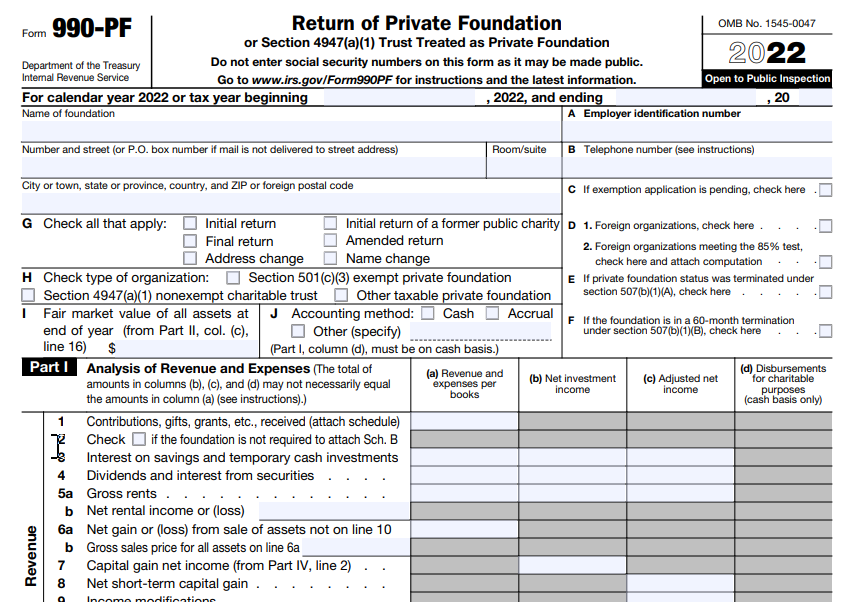

Source: instant990.org

Source: instant990.org

EFile Form 990 Series Form 990 Series Online, On this page you may download the 990 series filings on record for 2022. Form 990 must be filed by the fifteenth day of the fifth month following the organization’s tax year end date.

Source: instant990.org

Source: instant990.org

EFile Form 990 Series Form 990 Series Online, Form 990 irs filing deadlines and electronic filing information. If your organization’s accounting tax period starts on march 01, 2023, and ends on february 29, 2024, your form 990 is due by.

Source: blog.expresstaxexempt.com

Source: blog.expresstaxexempt.com

It’s Time to Meet Your January 18th 990 Series Return Deadline!, As the time for calendar year nonprofits to. When is irs form 990 due?

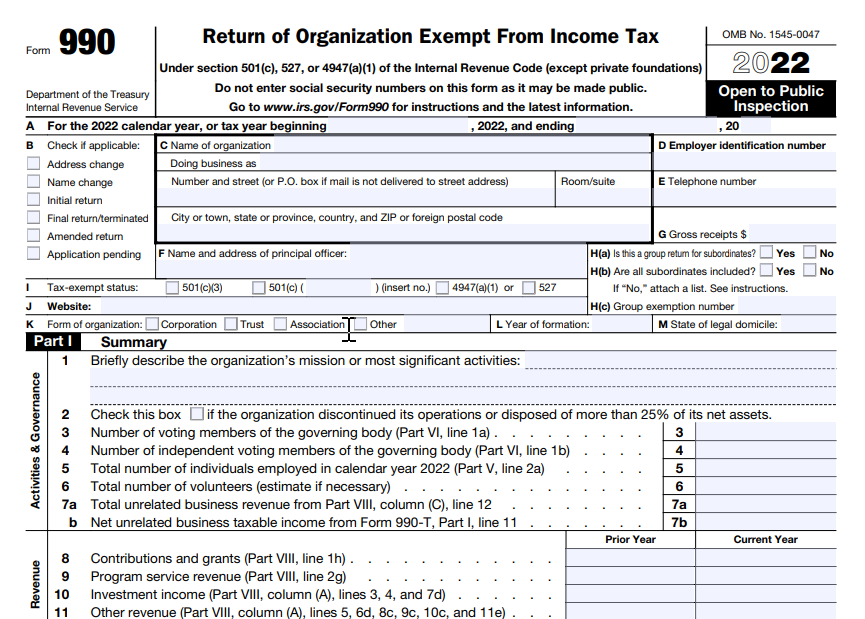

Source: whatisform.com

Source: whatisform.com

Form 990 Return of Organization Exempt From Tax, When is irs form 990 due? For organizations with an accounting tax period starting on march 01, 2023, and ending on february 29, 2024, form 990 is due by july 15, 2024.

Ending Date Of Tax Year.

On this page you may download the 990 series filings on record for 2022.

To Use The Table, You Must Know.

The deadline for filing form 990 is the 15th day of the 5th month after your organization’s accounting period ends.

Category: 2025